More than to 3.7 billion people use the Internet; that’s almost 50 percent of the world’s population. However, only 0.5 percent people of the world use blockchains. The state of the blockchain, it’s said, is at a point where the Internet was 20 years ago. However, if the speed of blockchain’s progress is anything to go by, we should have full-fledged blockchain-based applications accessible and affordable for all kinds of businesses within the next decade. VCs have invested more than $1 billion in blockchain technology already. The market size for blockchains is expected to grow to $20 billion by 2024. About 90 percent of the major banks in the U.S. and Europe are already exploring possibilities with blockchains. And no, this has nothing to do with convenience store chains on a nearby block in your community. Though glazed donuts, corn dogs, and Redvines are scrumptious, we have to move on to our blockchain primer!

There is no single blockchain

Our blockchain primer begins with a misconception: There is not one monolithic blockchain, but several blockchains. It’s surprising how many web resources use terminology such as “the blockchain,” which has possibly contributed to the widespread misunderstanding about the nature of this technology. Blockchain is a word used to refer to any digital and tamper-proof, publicly distributed ledger holding information about transactions.

One example is the blockchain that stores info of all transactions of the cryptocurrency bitcoin. Similarly, there are several other similar ledgers, each of which is a separate blockchain. These distributed ledgers are being used to track all kinds of cryptocurrencies, contracts information, health-care data, loans, etc.

Self-managed security and transparency

Decentralized — that’s the keyword to remember. There’s no central authority in a blockchain. The responsibility of security and privacy of data, and transparency of information — both depend on the participants in a blockchain. Here’s a quick refresher on how a blockchain works:

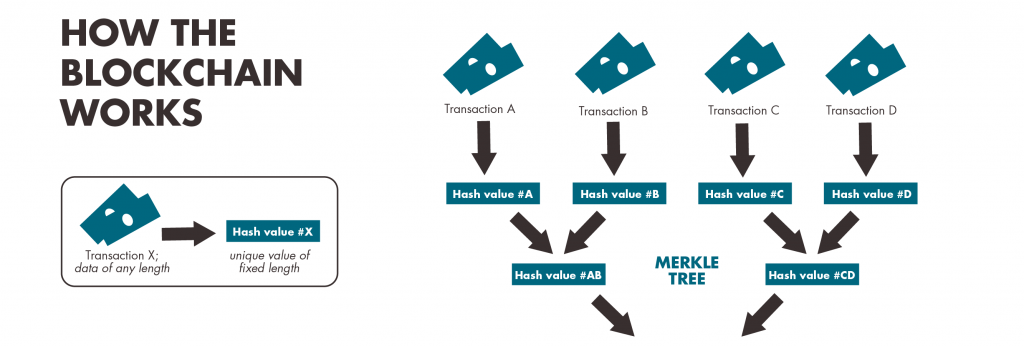

- Computers exchange information (to be stored in the shared ledger) over a peer-to-peer network.

- Each node in the network retains a copy of the ledger.

- Periodically, new transactions’ data is wrapped up into a block of data and added to the chain.

- Each block also contains a hash (a digital identifier for large data) of itself as well as the previous block.

- Adding a fake transaction in the block will mean that the embedded hashes need to be recalculated, along with all subsequent hashes.

- Because honest participants will continue to add valid information with reference to previous hashes, any malicious attempts are foiled.

Consolidation in blockchain-powered fintech

The potential of blockchain technology is acknowledged by the financial services industry. In the coming years, a lot of banks will adopt blockchain technology for applications such as auditing and compliance, working in close quarters with regulators. There was a lot of movement in the digital assets market in 2017, riding on increased adoption of blockchains.

In 2018, this will extend to markets such as pension funds, asset management, and payment services. Any company operating in the financial services market, or with a significant stake in the market, needs its leaders to be at the top of all these developments to make the most of these salient opportunities.

Blockchain technology is mainstream already

The initial perception around blockchain was that these were instruments of anti-establishment forces, looking to promote decentralized ecosystems of value exchange. With time, however, the merits of this technology have been identified and acknowledged by the tech innovators and game changers from across the globe.

IBM and Microsoft, for instance, have made rapid progress in commercializing blockchain technology. Major banks of the world have expressed their interest in this technology. Stock exchanges have even started buying products based on blockchain technology.

Implications of the decentralized system

In a blockchain, the computers involved in the system provide for the security and integrity of the database, which means the system doesn’t need any external trusted third party to maintain the database. This makes blockchain attractive for trading exchanges.

However, this is also what poses potential stumbling blocks in the path of success pertaining to this technology. For instance, it’s believed that the computing power required for processing bitcoins is equivalent to that needed by the 500 fastest supercomputers of the world combined. That is about as much power as needed to power most peoples’ flat screens that scale their entire living room wall!

Though near real-time confirmation of transactions was always touted as a key feature of blockchains, it was recently observed that it took close to 30 minutes for some bitcoin transactions to be confirmed as included in the blockchain. So, as transactions volume scales up, the decentralized nature of blockchains could pose challenges.

Public and private blockchains

Yes, there are public and private blockchains. These operate in a fairly similar way. A public blockchain is essentially open to all; just like the bitcoin ecosystem is available for any person to join. Because there is no immediate control over participant entry, the size of the blockchain quickly expands, and hence, verification of transactions becomes difficult.

On the other hand, private blockchains are controlled by private entities. These entities could implement their own rules to decide who gets to participate in the blockchain. Because the number of participants is restricted, the transactions are quicker.

There’s another third possibility — a consortium blockchain. In such a blockchain, a single entity doesn’t get full control of the blockchain. Predetermined nodes get to participate, ideally belonging to different entities of the consortium, with each having a transparent view of the database, without any single entity having complete control of the system.

Smart contracts

Smart contracts is a term that you’re very likely to hear a lot of in the times to come. This is an advanced blockchain application that ensures the execution of pre-agreed transactions when the prerequisites of the transaction are met.

This protocol can initiate automatic execution of actions once the contract terms are finalized. A simple example of this is: When a freelancer delivers the agreed work, the payment is automatically initiated from the other side.

A game changer

Blockchain technology has all the ingredients of turning into a game changer for many industries. This makes it imperative for IT leaders to fully understand the basics of the technology, as well as its potential applications, and that’s what this blockchain primer has been all about.

Photo credit: Pixabay